Setting SMART Financial Goals: Your Path To Financial Freedom

Vague wealth-building goals won't fuel your financial dreams. Goal-based investing with SMART goals is your key to unlocking a clear roadmap to success. Specific, Measurable, Achievable, Relevant, and Timely goals empower you to align your investments with your aspirations, whether it's early retirement, a dream vacation, or anything in between. Learn how SMART goals transform your investments from a fuzzy wishlist into a powerful path to financial freedom!

Femwealth Team

Last updated on 2 Jan 2025

Table of Contents

Have you ever felt lost when it comes to investing? You're not alone. Many people struggle with a vague sense of "wanting to grow their money" without a clear roadmap. This is where goal-based investing comes in. It focuses on setting SMART goals and aligning your investment strategy with those goals.

But what exactly are SMART financial goals, and how can they empower your investment journey? Let's dive deep!

Crafting SMART financial goals: Your key to financial success

Setting SMART financial goals is the cornerstone of achieving financial wellness. These goals provide a clear roadmap, ensuring your money works for you and guiding your money towards your dreams.

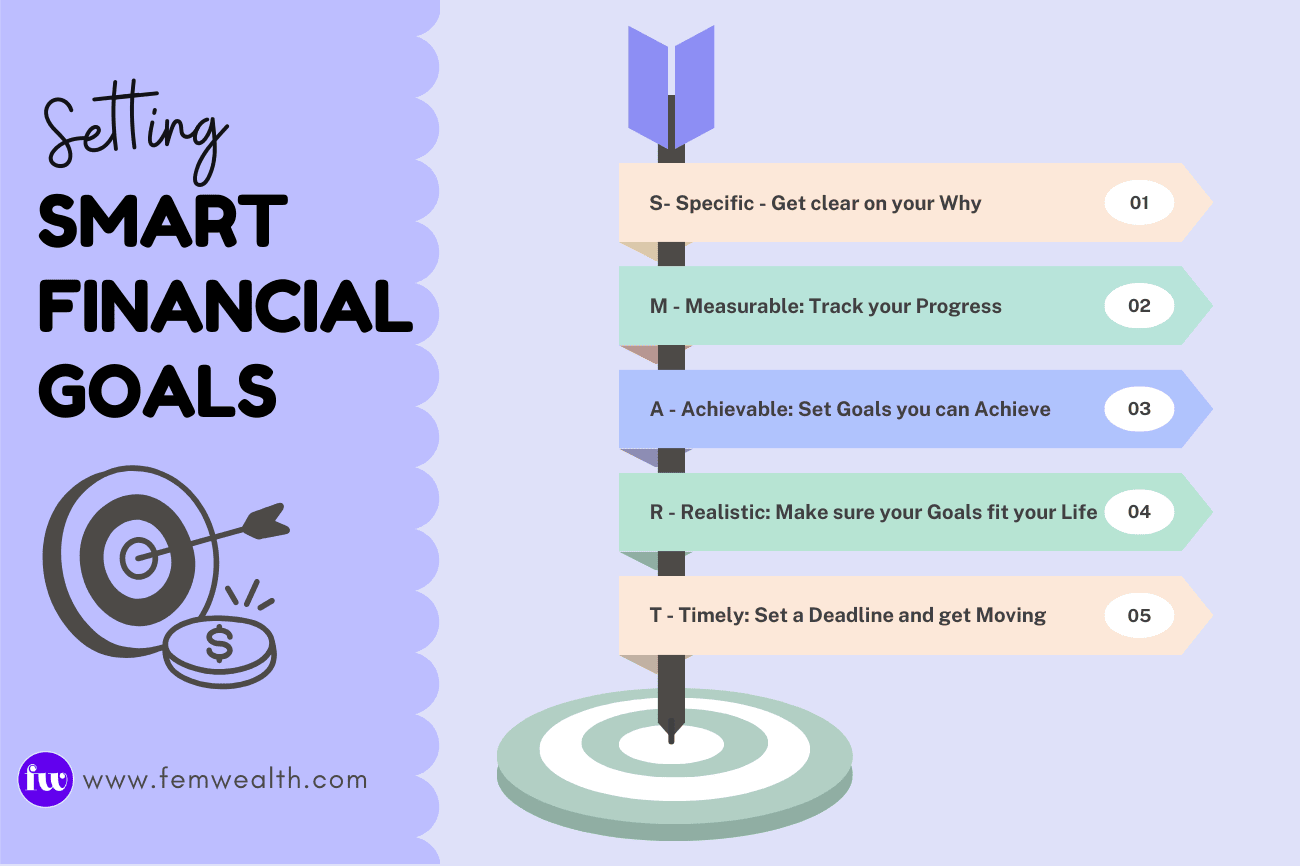

SMART is an acronym for Specific, Measurable, Achievable, Relevant, and Timely. These elements ensure your goals are well-defined, actionable, and have a clear timeframe for completion.

Here's a breakdown of the SMART framework to craft powerful financial goals:

S - Specific: Get clear on your Why

Ask yourself: What exactly do I want to achieve? Why is this important to me?

Example: Instead of just saying "save money," be specific! Say "I want to save $3,000 this year for an emergency fund to cover unexpected things like car trouble." This gives your goal a purpose and makes it more motivating.

S - Specific: Get clear on your Why

Ask yourself: What exactly do I want to achieve? Why is this important to me?

Example: Instead of just saying "save money," be specific! Say "I want to save $3,000 this year for an emergency fund to cover unexpected things like car trouble." This gives your goal a purpose and makes it more motivating.

M - Measurable: Track your Progress and Stay Motivated!

Ask yourself: How will I know I'm on the right track?

Example: If you're saving for a $3,000 emergency fund, set mini-goals to check in every few months. Maybe aim for $1,500 by the halfway point. This helps you stay motivated and see you're making real progress.

M - Measurable: Track your Progress and Stay Motivated!

Ask yourself: How will I know I'm on the right track?

Example: If you're saving for a $3,000 emergency fund, set mini-goals to check in every few months. Maybe aim for $1,500 by the halfway point. This helps you stay motivated and see you're making real progress.

A - Achievable: Set Goals you can achieve

Ask yourself: Is this goal realistic with my current situation?

Example: If you're living paycheck to paycheck, saving $3,000 in a year might be tough. Consider setting a smaller, more achievable goal and gradually increase it as you get more comfortable.

A - Achievable: Set Goals you can achieve

Ask yourself: Is this goal realistic with my current situation?

Example: If you're living paycheck to paycheck, saving $3,000 in a year might be tough. Consider setting a smaller, more achievable goal and gradually increase it as you get more comfortable.

R - Realistic: Make sure your Goals fit your Life

Ask yourself: Does this goal align with my overall financial picture and priorities?

Example: Let's say your main goal is to pay off high-interest credit card debt. Saving for a house down payment might need to wait until your debt is under control. Focus on what's most important for your financial situation right now.

R - Realistic: Make sure your Goals fit your Life

Ask yourself: Does this goal align with my overall financial picture and priorities?

Example: Let's say your main goal is to pay off high-interest credit card debt. Saving for a house down payment might need to wait until your debt is under control. Focus on what's most important for your financial situation right now.

T - Timely: Set a Deadline and get Moving!

Ask yourself: When do I want to achieve this goal?

Example: Instead of saying "save for an emergency fund someday," give yourself a specific timeframe, like "save $3,000 for an emergency fund by the end of the year." Having a deadline creates a sense of urgency and keeps you moving forward.

T - Timely: Set a Deadline and get Moving!

Ask yourself: When do I want to achieve this goal?

Example: Instead of saying "save for an emergency fund someday," give yourself a specific timeframe, like "save $3,000 for an emergency fund by the end of the year." Having a deadline creates a sense of urgency and keeps you moving forward.

Examples of SMART Goals in action

Specific: Accumulate a retirement corpus of $1 million to maintain your desired lifestyle after retirement.

Measurable: Track your retirement savings account and investment portfolio performance.

Achievable: Factor in your current income, potential future income growth, and projected retirement expenses.

Realistic: Financial security in retirement is a key priority.

Timely: You have a 20-year timeframe to reach your goal.

Building an Emergency Fund:

Specific: What and Why: You're saving $3,600 to build an emergency fund within a year. This is a financial safety net for unexpected expenses.

Measurable:How much and how to track progress: Your goal is to save $3,600 and you can track your progress by monitoring your emergency fund savings account balance or through a budgeting app.

Achievable: Is this something you can realistically accomplish? Analyze your income and expenses to see if you can save $300 per month. Consider setting up automatic transfers to make saving easier.

Realistic: Is this goal aligned with your overall financial goals? Having an emergency fund helps you avoid high-interest debt and gives you peace of mind. It's a crucial step towards financial security.

Timely: When will you reach your goal? You plan to achieve this goal within one year.

Goal: Save $3600 for building an emergency fund in one year.

SMART GOAL | Questions | Example |

S -> Specific | What and Why are you saving | Save $3600 for building an emergency fund in a year |

M -> Measurable | How much is the goal and how can I measure the progress of my goal | Save $3600 in a year. |

A -> Achievable | Is this something that you can accomplish? Do I have the necessary tools to achieve this goal | Based on my current income and expenses, I can save $300 every month. I can also set up automatic contributions to the emergency fund savings account. |

R -> Realistic | Is this realistic? Will it help me in reaching my financial goals? | Yes, if I can cut down on my impulsive purchases, spend less and earn more. |

T -> Timely | When will I reach my goal? | Achieve this goal in 1 year. |

Financial goals can vary from person to person depending on factors such as income level, existing debt or assets, life stage, and your financial priorities. You can have various financial goals for different stages of life.

Here's a breakdown of how financial goals might differ across life stages:

Young Adults (20s-30s): Common Goals: Building an emergency fund, paying off student loans, starting to invest for retirement.

Middle Age (40s-50s): Common Goals: Increasing retirement savings, saving for college education for children, potentially upgrading housing, managing any remaining debt.

Pre-Retirement: Common Goals: Maximising retirement contributions, ensuring long-term care plans are in place, finalizing estate plans, aiming to be debt-free before retirement.

Retirement: Common Goals: Living comfortably off retirement savings, managing healthcare costs, potentially generating income from investments.

These are just general examples. The key is to tailor your financial goals to your unique situation and aspirations.

Financial freedom starts with a plan. Let's get S.M.A.R.T. about our money!

Takeaway

Goal-based investing with SMART goals puts you in the driver's seat of your financial future. Define clear goals (Specific, Measurable, Achievable, Relevant, Timely), align your investments, and witness your money grow alongside your dreams! Consistency and discipline are your secret weapons. Take control of your finances today!

Subscribe to She Invests

A weekly newsletter filled with money tips & insights, curated for women.

Related posts

Goal-based investing is a powerful strategy that empowers anyone, regardless of income level, to take control of their financial future. This article breaks down the concepts and highlights the benefits. It also provides a clear roadmap to get started, including defining goals, calculating targets, and choosing suitable investments.

Learn how to save money effectively! Explore practical strategies to build healthy saving habits. Discover how to create a budget, set SMART goals, manage spending wisely, and achieve your financial goals. Building a healthy savings habit is your key to unlocking financial freedom.