Achieve Financial Freedom Early: With Goal Based Investing Roadmap

Goal-based investing is a powerful strategy that empowers anyone, regardless of income level, to take control of their financial future. This article breaks down the concepts and highlights the benefits. Goal-based investing helps you achieve your dreams by creating a personalized roadmap for your money. It also provides a clear roadmap to get started, including defining goals, calculating targets, and choosing suitable investments.

Femwealth Team

Last updated on 25 Jan 2025

Table of Contents

What is Goal Based Investing

Ever feel like your finances are stuck in a holding pattern? You're earning money, but it just disappears without a trace. Wouldn't it be amazing to see your savings actually grow and take you closer to those amazing goals you have, whether it is a dream vacation or a secure retirement.

This is where goal-based investing comes in as your secret weapon🛡️! It's a financial strategy that is quite suitable for women who want to take control of their money and make it work for them. Whether it's that dream vacation to Europe, a rocking retirement fund, or securing your little one's college education, goal-based investing helps you chart a course and watch your money work its magic.

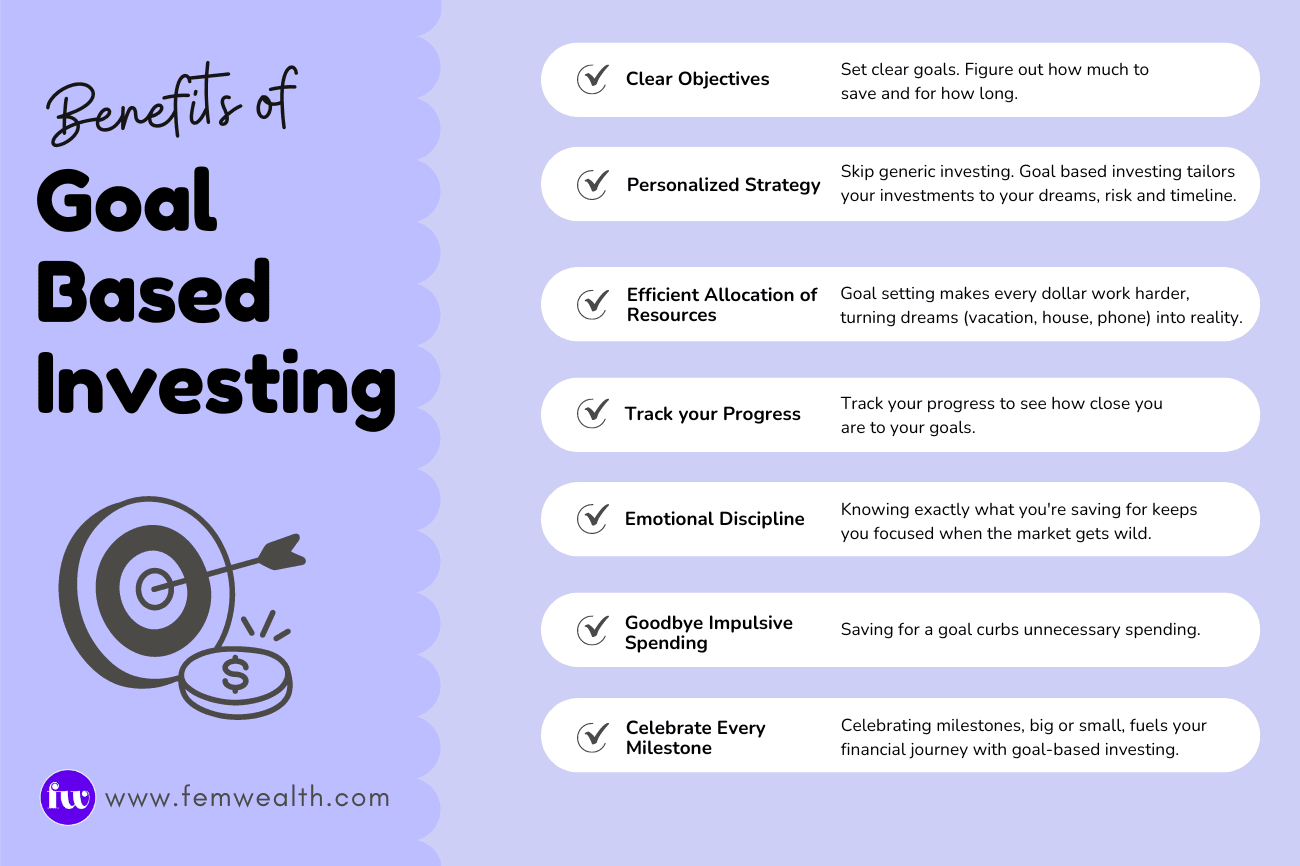

7 Benefits of Goal Based Investing

Goal-based investing is like using a GPS for your financial journey. It sets your destination (dream vacation! new car! retirement! ️) and guides you there by showing you how much to save and where to invest your hard-earned money.

Here are the key benefits:

Clear objectives - Imagine hitting the road without a map, just a vague idea of where you want to end up. That's what finances can feel like without clear goals! Plan your life's financial road trip with stops (your goals) along the way. Identify and prioritize your goals and understand exactly how much you need to invest and for how long.

Personalized Strategy - Are you a mountain person with some adventure thrown in? Maybe you like to spend time relaxing on the beach. Your vacation preferences are unique to you, and so are your finances. Similarly, your financial strategy is like creating a personalized travel itinerary for your money. Instead of a generic approach, you design an investment plan that considers: your goals, your time horizon and your risk tolerance. Having goals helps you make it specific to you.

Efficient Allocation of Resources - Let's continue to use vacations as an analogy. Think of your finances like planning for a vacation. You would budget for flights, hotels, food, activities etc. Each of these would need different amounts of money. Similarly, by setting your goals (dream vacation, a house, new phone etc), you can allocate your resources efficiently, making sure every dollar goes towards something specific. It is like having a bunch of tiny labeled jars – "Emergency Fund," "New Phone Fund," "Weekend Getaway Fund" etc.

- Track your Progress - Tracking progress of your financial goals is like following google maps on your trip. It helps to keep checking google maps even if you know the route. It gives you an idea of how far you've come or how much longer it would take. Instead of just watching the market, you see how your investments are stacking up against your dream vacation, new car down payment, or retirement goals. This keeps you focused and motivated!

- Emotional Discipline - Investing can be an emotional roller coaster. Set clear goals. Knowing exactly what you're saving for is going to keep you focused when the market gets wild.

- Goodbye Impulsive Spending - Knowing exactly what you're saving for makes you less likely to splurge on unnecessary purchases. Every penny saved is a step closer to your dream!

- Celebrate Every Milestone - Reaching a savings target, no matter how big or small, is a victory! Goal-based investing keeps you motivated and excited about your financial journey.

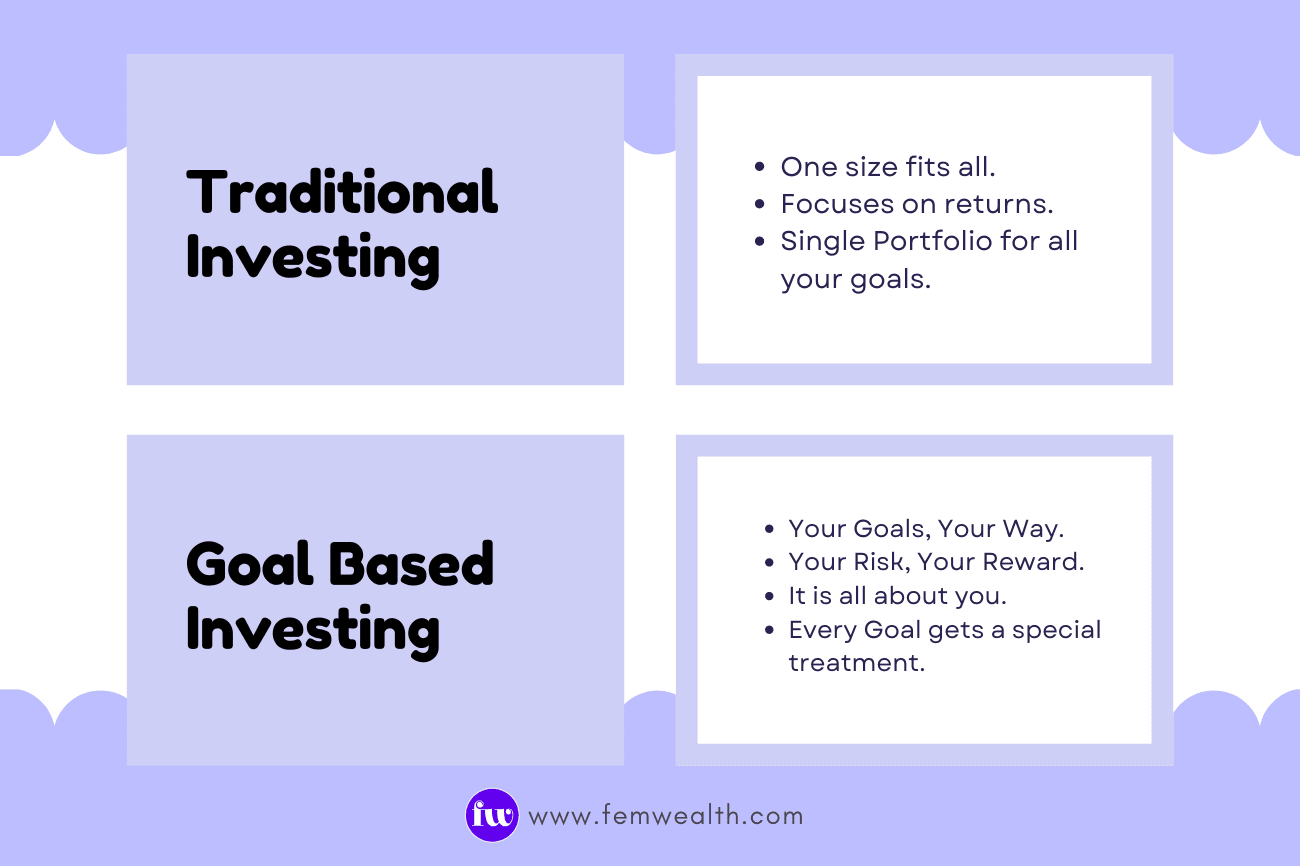

Goal Based Investing vs Traditional Investing

Ever feel lost in the world of investing? Should you just pick some stocks and hope for the best (traditional investing) or is there a better way? Let us break it down in a manner that makes sense for your wallet.

Traditional Investing

You invest based on tips or trends, hoping for the best. It is more like playing darts blindfolded - hoping to hit the bullseye (In the case of stocks, you just want big returns). This approach might work, but it's risky and does not consider your own goals. Some reasons why it might not be the best fit for you:

One size fits all - Life goals come in all shapes and sizes - a dream vacation, a child's education, retirement. Traditional investing doesn't consider these personal needs

Focuses on returns - The focus is often on beating the market and maximizing returns, which might often does not work.

Single Portfolio for all goals - Keeping all your investments in one portfolio means your risk and returns are the same for every goal, regardless of when you need the money.

Goal Based Investing

This is like having a laser pointer for your darts. You set a specific goal (dream vacation, new car), figure out how much you need, and then choose investments to get you there. It's all about making the right choice for where to put your money so that it works for that specific goal. Here's how goal based investing makes your money matter -

- Your Goals, Your Way: You define what matters - retirement nest egg, child's college fund, epic adventure. Goal-based investing tailors your investments to fit those dreams.

- Matching Risk to your Goals: You choose investments based on how much risk you can tolerate and the timeframe for each goal. A short-term goal like a car might involve lower-risk investments like bonds, while retirement might involve a mix of stocks and bonds for long-term growth.

- It is all about You : The success of goal-based investing is measured by how well you are able to meet your life goals. It is not about beating the market.

Stay Focused, Stay Motivated: Knowing exactly what you're saving for keeps you laser-focused and helps you avoid knee-jerk decisions based on market noise.

Every Goal Gets Special Treatment: Treat each dream (beach vacation, college fund) as a unique milestone and invest accordingly.

Why is Goal Based Investing perfect for women

Why is Goal Based Investing perfect for women

Studies have shown that women are detail-oriented, goal-driven, and prioritize long-term security. Goal-Based Investing Empowers Women as it taps into these strengths perfectly. Here's how:

- Aligns with Your Financial Goals - Whether it's crushing retirement or funding your kid's college fund, goal-based investing aligns your investments with those milestones. No more chasing random returns!

- Better Risk Management - Feeling cautious? Goal-based investing lets you personalize your risk level. This means you can invest with confidence, knowing you're not taking on more risk than you're comfortable with.

- Long-Term Vision - Women are likely to hold investments for the long term. Goal-based investing aligns perfectly with this, keeping the focus on the future you're building.

Disciplined Approach - Studies show that women are disciplined savers. Regular contributions keep you on track to reach your goals.

Uniquely For You: From career changes to child care, women often have unique financial goals. Goal-based investing lets you factor these in, creating a personalized investment strategy.

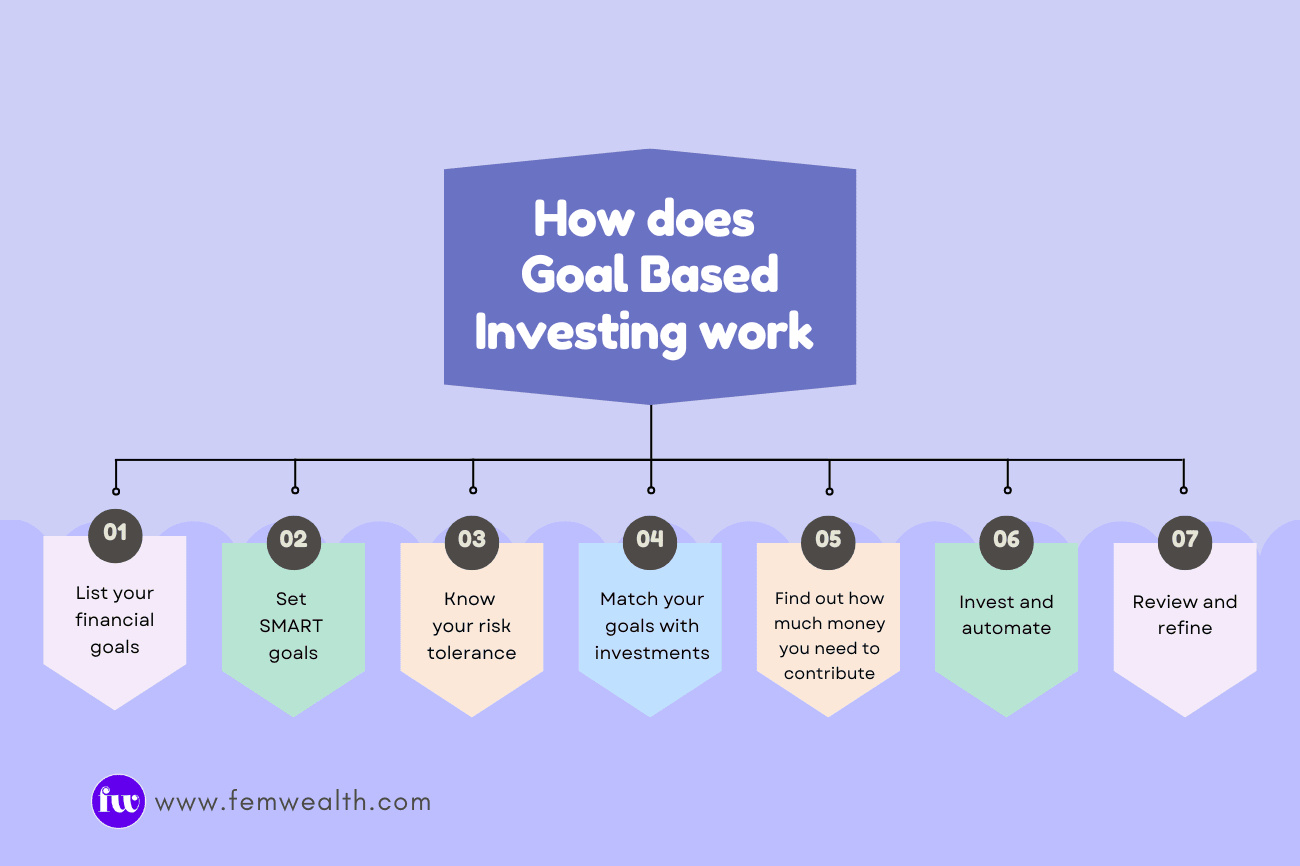

How does Goal Based Investing Work

How does Goal Based Investing Work

Forget chasing random returns - goal-based investing is your secret weapon for making your money work towards what you truly want. Here's how to get started in simple steps:

- List Your Financial Goals - Write down everything from that dream vacation to your child's college education or your retirement nest egg. Think about what you want to achieve financially in the short, medium, and long term - list it all!

- Set SMART Goals - Vague wishes won't cut it. Turn your dreams into Specific, Measurable, Attainable, Relevant, and Time-bound goals. For example, instead of just saying "save for retirement," aim for a specific dollar amount by your desired retirement age. Don't forget to factor in inflation, the rising cost of things over time.

- Know Your Risk Tolerance - Are you okay with some bumps in the road (higher risk, potentially higher returns) or do you prefer a smoother ride (lower risk, lower returns)? Understanding your comfort level with risk will help you choose the right investments.

- Match Your Goals With Investments - Based on your goals and risk tolerance, you can choose investments like stocks, bonds, or mutual funds. Generally, stocks offer higher potential returns (and risks) for long-term goals, while bonds provide stability for shorter-term needs.

- Find out how much money you need to contribute - Figure out how much you need to invest regularly to reach your goals.

- Invest and Automate - Set up automatic deposits to your investment accounts. This ensures you stay on track and avoid the temptation to spend.

- Review and Refine - Remember, the key to successful goal-based investing is regular monitoring and adjustment. This means regularly checking in on your progress and adjusting your investments as needed, to stay on course to meet your goals.

Takeaway

Takeaway

Goal-based investing empowers you to take control of your financial future. Set clear goals, prioritize them, and factor in your risk tolerance. Choose investments that align with your goals and timeframes. Regularly monitor your progress and adjust your strategy as needed. This results in a personalized plan to make your money work towards what matters most to you.

Subscribe to She Invests

A weekly newsletter filled with money tips & insights, curated for women.

Related posts

Learn how to save money effectively! Explore practical strategies to build healthy saving habits. Discover how to create a budget, set SMART goals, manage spending wisely, and achieve your financial goals. Building a healthy savings habit is your key to unlocking financial freedom.

Prioritization is your secret weapon, transforming that jumbled wishlist into a clear roadmap to financial success. By sorting your goals into bite-sized chunks (short-term, mid-term, and long-term), you can focus your energy on what matters most right now. Prioritization of goals lets you track your progress...