Spend Wisely, Save Smart: Practical Tips to Manage Your Money Effectively

Learn how to save money effectively! Explore practical strategies to build healthy saving habits. Discover how to create a budget, set SMART goals, manage spending wisely, and achieve your financial goals. Building a healthy savings habit is your key to unlocking financial freedom.

Femwealth Team

Updated on 17 Jun 2024

Table of Contents

Why saving matters

Earning money is a great accomplishment, but it's equally important to spend it wisely. Careful spending doesn't necessarily mean depriving yourself; it's about striking a balance between enjoying your hard-earned money and planning for the future.

Imagine this: you receive your monthly paycheck, cover your essential expenses, and have some money left over. Suddenly, your car breaks down, leaving you with a hefty repair bill. If you haven't been saving, this unexpected expense can throw your entire budget off track.

Here's the flip side: if your spending habits drain your entire paycheck, an unexpected expense can push you into debt. This cycle of overspending can leave you with little to no savings, jeopardizing your financial stability in the long run. The key to saving isn't just earning more, it's controlling how much you spend.

The key to saving isn't just earning more, it is in controlling how much you spend.

Having a savings buffer allows you to handle emergencies without financial stress. Here's why saving is crucial:

Financial Security - Savings provide a safety net for unforeseen events like job loss, medical bills, or car repairs.

Achieving Goals: Whether it's a dream vacation, a down payment on a house, or a comfortable retirement, saving helps you turn financial goals into reality.

Peace of Mind: Knowing you have a financial cushion reduces stress and allows you to make financial decisions with confidence.

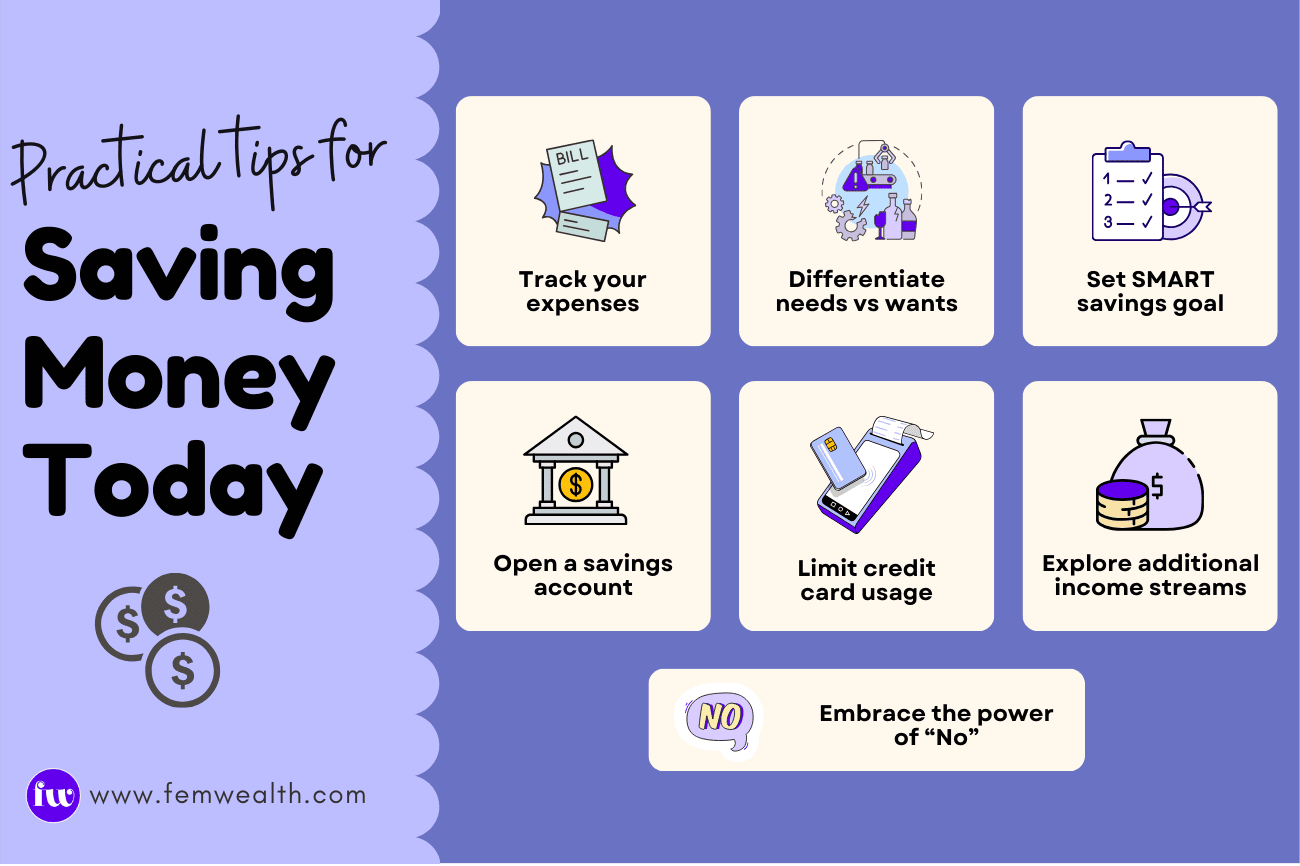

Practical steps to start saving money today

Saving money might seem daunting initially, but with a few simple strategies, you can establish healthy financial habits:

Track your expenses - Understanding where your money goes is the first step to saving more. Keep a record of your monthly expenditures, including groceries, rent, utilities, entertainment, and debt payments. Categorize your spending as needs (essentials) and wants (discretionary items). Budgeting apps and spreadsheets simplify expense tracking. Having a budget keeps a check on your expenses. You can now focus on your goals with the help of the savings.

- Differentiate Needs vs Wants: Needs are essential for your well-being, such as groceries, rent, utilities, and transportation. Wants, on the other hand, are desirable but not indispensable, like dining out, expensive clothing, or the latest gadgets. Knowing the difference between needs and wants helps you put your money towards the things you really need and find ways to save on the extras.

- Set SMART Savings Goal: Having a clear purpose for saving motivates you to stay on track. Set Specific, Measurable, Achievable, Realistic and Timely (SMART) goals. Do you dream of a new car in two years? A vacation fund for next summer? Quantify your goals and set deadlines to achieve them.

- Open a Dedicated Savings Account: Separate your savings from your checking account to avoid the temptation of impulsive spending. Setting up automatic transfers from your checking account to your savings ensures a consistent influx of funds into your savings without any manual effort. Consider opening multiple savings accounts for different goals, like a car fund, vacation fund, or an emergency fund.

- Limit Credit Card Usage:Credit cards can be convenient, but they can also lead to debt if not managed responsibly. Pay your credit card in full each month to steer clear of interest charges.

- Explore Additional Income Streams: Consider freelancing, selling unused items online, or starting a side hustle to boost your income and accelerate your saving efforts.

- Embrace the Power of "No": Don't feel pressured to keep up with the Joneses. Learn to politely decline unnecessary expenses, like impulse purchases or social outings that don't fit your budget.

Takeaway

Saving money is a journey, not a destination. Start small, celebrate your milestones, and gradually increase your savings as your financial situation improves. Remember, even small amounts saved consistently can grow significantly over time. By following these tips and adopting a mindful approach to spending, you'll be well on your way to achieving financial security and fulfilling your financial goals.

Subscribe to She Invests

A weekly newsletter filled with money tips & insights, curated for women.

Related posts

Looking to reset your spending habits and take control of your money? This weekly money detox plan is your roadmap to a healthier financial future. Spread over four action-packed weeks, this guide will help you track your expenses, identify leaks, challenge yourself with mindful spending strategies, and finally, build a sustainable financial plan.

Unleash the power of money ratios! These financial health indicators, like savings rate and debt-to-asset ratio, help you track progress, make smart decisions, and build a secure future. Learn more and take control of your money!