Conquering Your Finances: Prioritizing And Time-Boxing Your Financial Goals

Prioritization is your secret weapon, transforming that jumbled wishlist into a clear roadmap to financial success. By sorting your goals into bite-sized chunks (short-term, mid-term, and long-term), you can focus your energy on what matters most right now. Prioritization of goals lets you track your progress and keeps you motivated to conquer each goal, one by one. Plus, automating makes the whole process a breeze - set it and forget it while your future self thanks you!

Femwealth Team

Last updated on 17 Jul 2024

Table of Contents

Let's face it, financial goals can feel like a never-ending wishlist - from that dream vacation to Bali (with all the massages!), a comfy nest egg for retirement, or maybe finally ditching that rent check and owning your own place. But with so many desires, figuring out where to even start can feel like climbing Mount Everest in flip flops. On top of that budgeting for all the three goals at once can leave you feeling overwhelmed and stuck.

Just like you wouldn't try to bake a cake without a recipe, you need a plan to conquer your financial goals. The secret weapon? Prioritization!

This article equips you with a framework to prioritize financial goals and categorize them into timebound buckets.

Why should you Prioritize Financial Goals

Prioritization transforms a jumbled list of desires into a clear roadmap. Here's why it matters:

Focus your energy and resources: By tackling the most important goals first, you allocate your money and efforts strategically.

Setting financial priorities - You can forget the guesswork and actually track your progress towards your goal.

Motivation and Momentum: Seeing progress on high-priority goals fuels motivation to tackle the next ones.

The Power of Prioritization

Not all financial goals are created equal. Some demand immediate attention, while others can be tackled after some time. The key to success lies in prioritizing them effectively. Here's a simple trick: categorize your goals based on urgency and importance:

1. Immediate attention

This bucket holds goals with tight deadlines. The prime example? High interest debt. Paying off credit cards or personal loans falls under this umbrella. Focus on paying off these debts first to free up cash flow for future goals.

2. Important goals

These goals hold significant value for your future but might not have a pressing deadline. Saving for a dream wedding, a child's education, a house down payment, or starting a business all fall into this category. While important, they can often be planned for over a longer timeframe.

3. Critical goals

These goals form the foundation of your financial well-being and should never be neglected. Building an emergency fund and saving for retirement are paramount. An emergency fund acts as a safety net for unexpected expenses, while retirement savings ensure a comfortable life post-retirement.

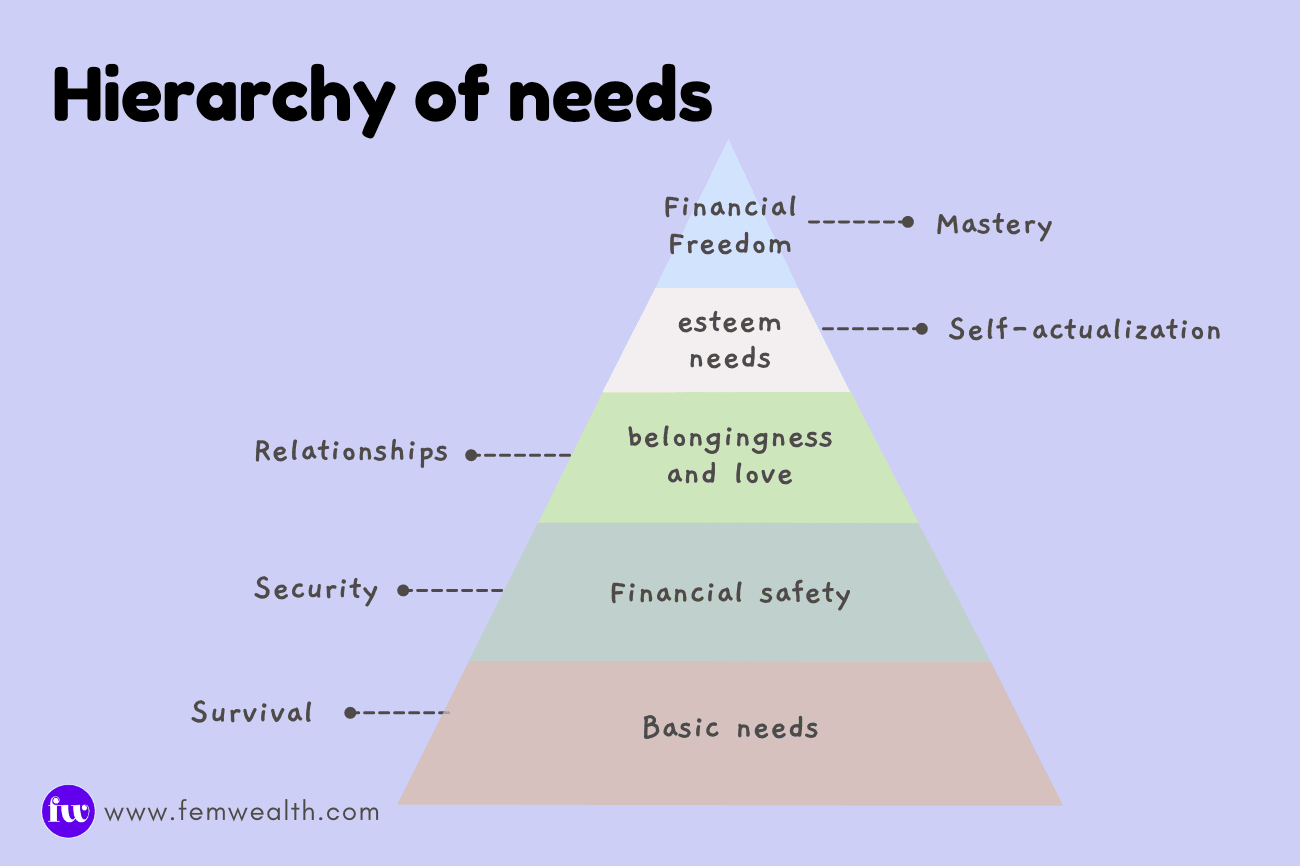

The Hierarchy of Needs: A Framework for Financial Prioritization

Planning and prioritizing your finances goes beyond numbers; it is about fulfilling your dreams and aspirations. This can be viewed through the lens of Abraham Maslow's Hierarchy of Needs. Each of these stages is essential in creating and preserving wealth. Here's a breakdown of the five stages of needs, highlighting the financial goals that correspond to each.

Basic Needs(Survival) - At the bottom of the pyramid lies fulfilling basic needs like food, clothing, and shelter. Here, the focus is on maintaining a steady cash flow and reducing debt. Prioritize reducing unnecessary expenses and living within your means.

Financial Safety (Security) - Building your emergency fund, Health insurance, Protecting your assets like house, car etc. This stage involves protecting yourself and your loved ones from financial hardship.

Belongingness and Love (Relationships) - Involves planning a safe future for you and your family. Goals in this stage include saving for a home, funding your children's education, and saving for retirement.

Esteem Needs (Self-Actualization): This stage is about achieving long-term goals that contribute to your sense of accomplishment, status, responsibility and well-being. Examples include saving for long-term care, securing a comfortable retirement lifestyle, and contributing to society through charitable giving.

Financial Freedom (Mastery): This is the ultimate goal, where financial worries cease to exist. You have the freedom to pursue your passions and make financial decisions without stress. Estate planning and business succession planning often come into play at this stage.

This framework is a guide, not a rigid rule-book. Your priorities will be unique based on your life stage, income, and family situation.

Timeboxing your Goals: Short-Term, Mid-Term and Long-Term

Timeboxing your Goals: Short-Term, Mid-Term and Long-Term

Now that you have a prioritized list, categorize your goals based on their time horizon:

1. Short-Term Goals: Building the Foundation

Your Short-term financial goals are your stepping stones towards financial success. They are about laying the groundwork. They are typically set to be achieved in a year or two. Some examples of short-term goals are :

- Saving for a vacation

- Building an Emergency fund

- Purchasing a new gadget.

- Saving for that new outfit.

Example: Debbie, a graphic designer, aims to save up for a new laptop to enhance her work efficiency. She plans to set aside a portion of her monthly income to meet this goal within the next six months.

2. Mid-Term Goals: The Building Blocks

Saving for a big purchase - Dreaming of a new car or a down payment on a house.

Starting a business.

Paying off debt

Building credit

Example: Maria, a marketing professional, wants to buy a car in 2 years. She researches used cars and determines she needs $8,000 for a down payment. Maria sets up automatic transfers of $333 per month to reach her goal.

3. Long-Term Goals: Securing your Future

Long-term goals are about your golden years and beyond. Here's where the magic of compound interest comes into play. The earlier you start saving for retirement, the more time your money has to grow. They often stretch beyond five years into the future. They include :

- Retirement planning

- Building wealth

- Legacy Planning

- Saving for children's education

Example: Consider the case of Aisha, a software engineer, who is investing in a diversified portfolio to secure her retirement. With a disciplined approach to savings and investments, she's ensuring a comfortable and independent retirement.

Automate your savings! Set up recurring transfers to your savings goals. This "set it and forget it" approach ensures you reach your targets without even thinking about it.

Taking action: Your Roadmap to Financial Success

Taking action: Your Roadmap to Financial Success

With your prioritized and timebound goals in place, it's time for action! Here are some tips:

Create a Budget: A budget allocates your income towards your goals, ensuring you stay on track.

Automate Your Finances: Set up automatic transfers to savings and investment accounts.

Track Your Progress: Regularly monitor your progress to stay motivated and make adjustments as needed.

Takeaway

Takeaway

Prioritization is a continuous process. Revisit your goals regularly, adapt them to changing circumstances, and celebrate your achievements along the way. By strategically prioritizing and timeboxing your financial goals, you'll be well on your way to financial freedom and a secure future.

Subscribe to She Invests

A weekly newsletter filled with money tips & insights, curated for women.

Related posts

Learn how to save money effectively! Explore practical strategies to build healthy saving habits. Discover how to create a budget, set SMART goals, manage spending wisely, and achieve your financial goals. Building a healthy savings habit is your key to unlocking financial freedom.