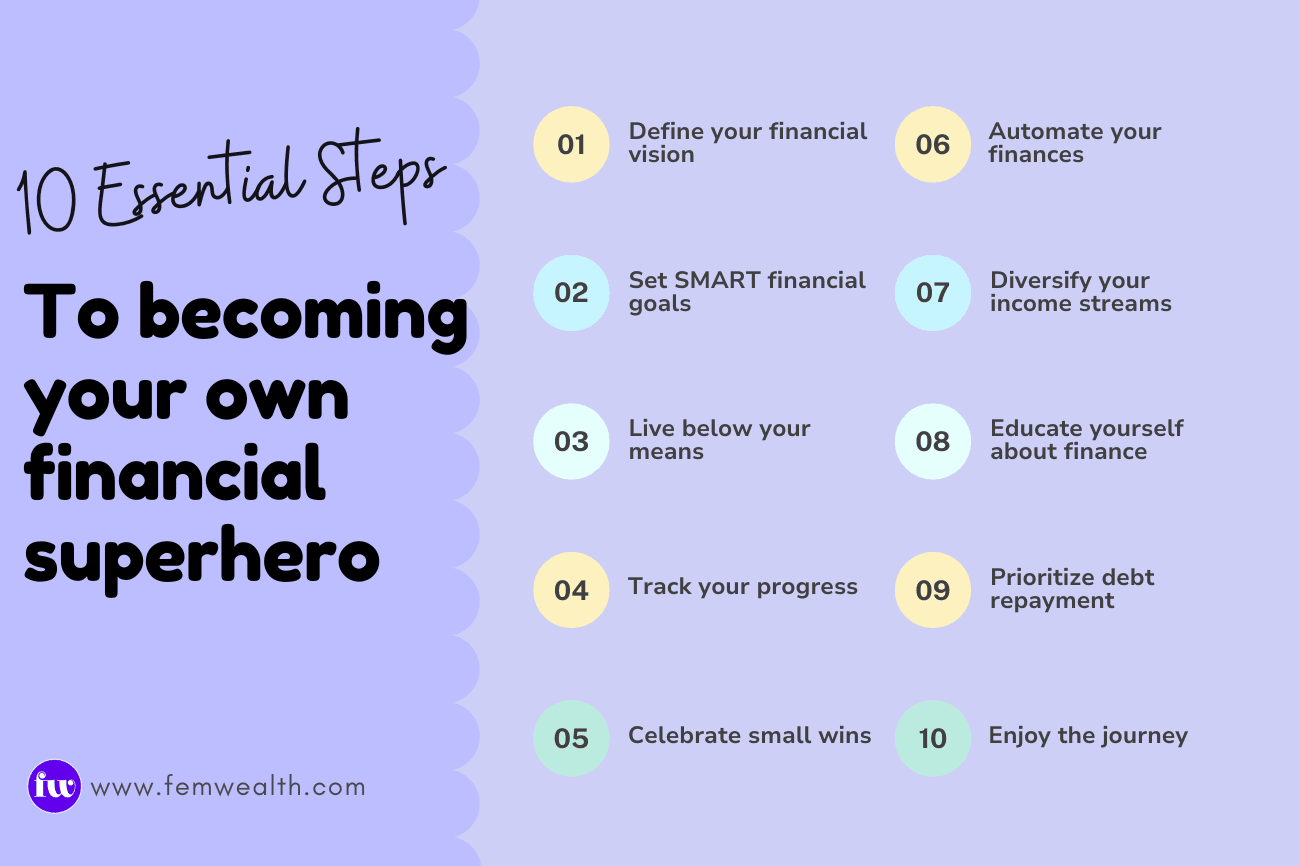

Financial Independence For women: 10 Essential Steps to Becoming Your Own Financial Superhero

Discover the secrets to financial independence for women. Learn practical steps to build wealth, from setting clear goals to diversifying income streams. Empower yourself to achieve financial freedom and live life on your own terms.

Femwealth Team

Last Updated on 28 Jul 2024

Table of Contents

Financial independence is the ultimate superpower for women. It is all about having the freedom to live life on your own terms and the ability to pursue passions. While the journey might seem daunting, it's achievable with the right mindset and strategies.

Let's dive into ten actionable steps to help you become your own financial superhero.

1. Define your financial vision

The first step to financial independence is understanding what it means to you. Visualize your ideal financial future. Are you aiming for an early retirement, a comfortable lifestyle, or building a substantial net worth? For example, if your goal is to retire by 50, calculate how much you would need to save each month to reach this goal. Clearly defining your vision will keep you motivated and focused.

2. Set SMART financial goals

Create specific, measurable, achievable, realistic, and timely financial goals. Break down large objectives into small, manageable steps. This will help you track your progress and stay motivated. For example, instead of saying "I want to save some money for my emergency fund", say "I want to save $10,000 by the end of the year for my emergency fund".

3. Live below your means

This fundamental principle involves spending less than you earn and allocating the surplus towards savings and investments. It is all about making conscious choices aligned with your financial goals. This habit will accelerate your journey to financial freedom. Small, consistent savings can lead to significant growth over time.

4. Track your progress

Regularly monitoring income, expenses, and savings helps you identify spending patterns, areas for improvement, and progress toward your goals. Monitoring your financial progress helps identify areas where you can cut back and increase savings. Use budgeting tools or spreadsheets to monitor your financial health.

5. Celebrate small wins

Reaching financial milestones is a cause for celebration. Celebrate your small victories along the way, whether it's paying off a debt, reaching a savings milestone, or increasing your income. Positive reinforcement will keep you motivated.

6. Automate your finances

Set up automatic transfers from your checking account to your savings and investment accounts. This ensures consistent savings and eliminates the temptation to spend impulsively. Automating bill payments can also help avoid late fees and penalties.

7. Diversify your income streams

Relying on a single income source can be risky. Explore opportunities to create multiple income streams, such as freelancing, starting a side hustle, or investing in rental properties. Diversifying your income can provide financial security and accelerate wealth building.

8. Educate yourself about finance

Financial literacy is important for making informed money decisions. Invest time in learning about budgeting, investing, and financial planning. The more you know, the better equipped you'll be to achieve your financial goals

9. Prioritize debt repayment

High-interest debt can hinder financial progress. Create a plan to payoff credit card debt and other loans as quickly as possible. By systematically eliminating debt, you'll free up more money to save and invest.

10. Enjoy the journey

Financial independence is a long-term goal, so it's important to enjoy the process. Celebrate your successes, learn from setbacks, and enjoy the process. Find the balance between saving and enjoying life. Remember, it's about building a fulfilling life, not just accumulating wealth.

Investing is crucial for long-term financial growth. Start by educating yourself about different investment options like stocks, bonds, and mutual funds.

Takeaway

The financial landscape is constantly evolving. Stay informed about personal finance trends, investment strategies, and economic conditions.

By following these steps and maintaining a disciplined approach, you can take control of your finances and achieve financial independence. Remember, every woman has the potential to be a financial superhero.

Subscribe to She Invests

A weekly newsletter filled with money tips & insights, curated for women.

Related posts

Learn how to save money effectively! Explore practical strategies to build healthy saving habits. Discover how to create a budget, set SMART goals, manage spending wisely, and achieve your financial goals. Building a healthy savings habit is your key to unlocking financial freedom.

Starting small should not hold you back from investing! Investing is about starting early and being consistent. Learn how to overcome fear, invest with tiny amounts, and build a secure financial future with mutual funds, spare change strategies, and smart habits. Remember, investing is a long-term strategy for building wealth.