Master Your Money: A Guide to Personal Finance for a Brighter Future

Take control of your finances with this comprehensive guide to personal finance. Learn about income, saving, spending, investing, protection, and more!

Femwealth Team

7 Jan 2025

Table of Contents

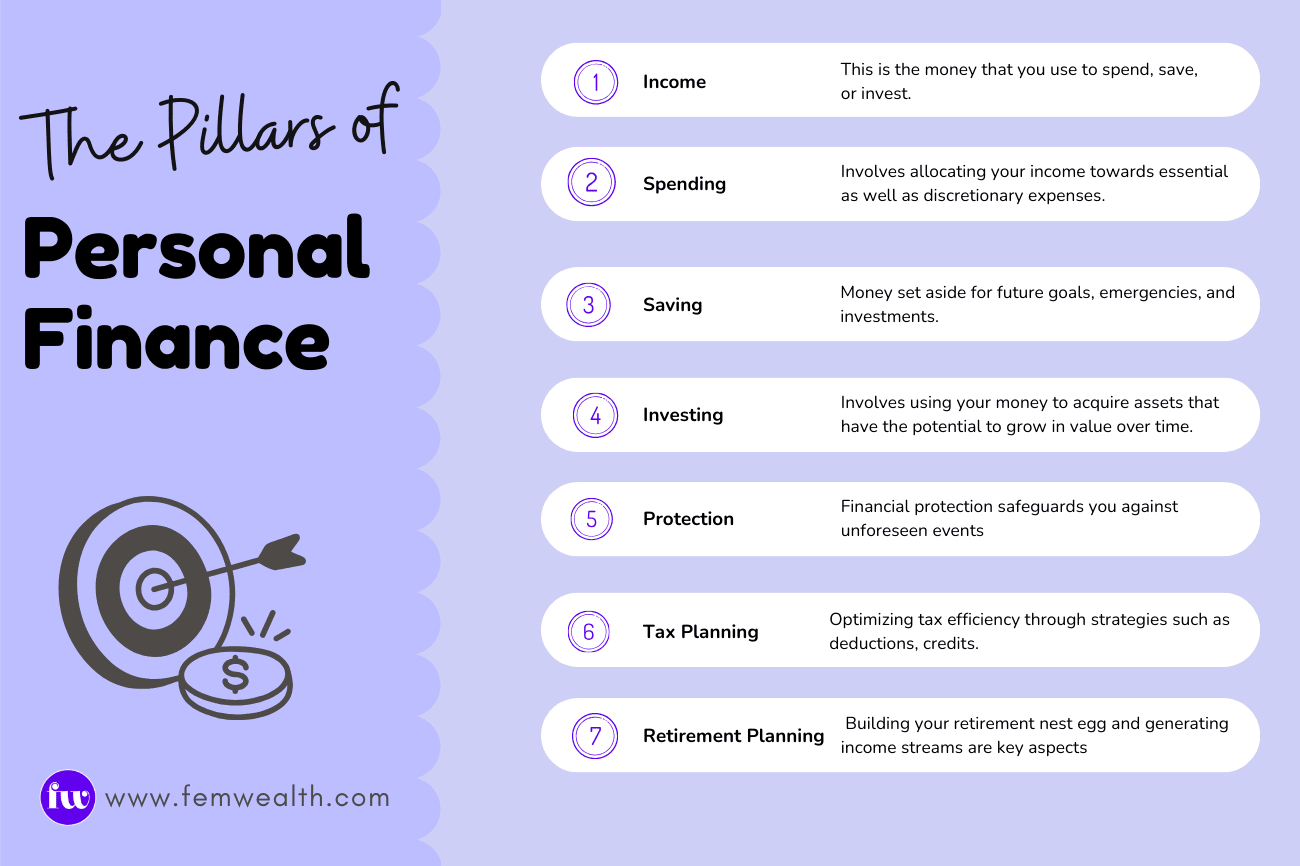

The Pillars of Personal Finance

Personal finance – it's all about taking control of your money. It is the cornerstone of your financial well-being. It's about taking control of your financial situation today to build a secure future for yourself and your loved ones.

This guide breaks down the key areas of personal finance, empowering you to make informed decisions and achieve your financial goals.

Income - This is the foundation of your financial plan. It encompasses your salary, bonuses, dividends, interest, and pensions. This is the money that you use to spend, save, or invest.

- Spending - Spending can be done with cash or credit (borrowed money). It involves allocating your income towards essential expenses like rent, food, and utilities, as well as discretionary spending on entertainment, travel, hobbies, and debt payments. Track your spending habits to identify areas for potential savings.

- Saving- This is the money you set aside for future goals, emergencies, and investments. Savings can be held in cash, savings accounts, or money market securities.

- Investing- While saving keeps your money safe,investing allows it to grow. Investing involves using your money to acquire assets that have the potential to grow in value over time. Popular investment options include stocks, bonds, mutual funds, and real estate.

- Protection - Financial protection safeguards you against unforeseen events. Common examples include life insurance, mortgage protection, health insurance, and critical illness insurance.

- Tax Planning - Optimizing tax efficiency through strategies such as deductions, credits, and retirement accounts to minimize tax liabilities.

- Retirement Planning- Planning for retirement early allows you to leverage the power of compound interest, where even small investments can grow significantly over time. Building your retirement nest egg and generating income streams are key aspects of retirement planning.

Financial Literacy is the key

Understanding basic financial concepts empowers you to distinguish between good and bad financial advice. Develop your financial literacy so that you can make informed financial choices and navigate the world of personal finance with confidence.

Enjoy your financial journey

While financial planning is crucial, it shouldn't come at the expense of enjoying life. Make sure to reward yourself occasionally with a well-deserved vacation, a special purchase, or a nice dinner out. These rewards celebrate your progress and provide a taste of the financial independence you're building.

Takeaway

Financial planning is a continuous journey. By taking control of your finances today, you're paving the way for a brighter and more secure tomorrow.

Subscribe to She Invests

A weekly newsletter filled with money tips & insights, curated for women.

Related posts

Unlock your financial freedom journey! Learn the 7 powerful personal finance strategies including budgeting, investing, building passive income, and more. This guide will empower you to take control of your finances and achieve your financial goals.

Managing your money can be boring. It is an endless stream of things to do. And since we don't see the payback in real-time, we feel we might be wasting out time. A few techniques can be used to ensure that the boredom is reduced...